Maryland Association of Counties Responds to Community Reinvestment and Repair Fund Survey Results Report

Jan 02, 2024

Under the Cannabis Reform Act, counties have broad flexibility in determining how to allocate the funds, including working with local organizations to support marginalized communities.

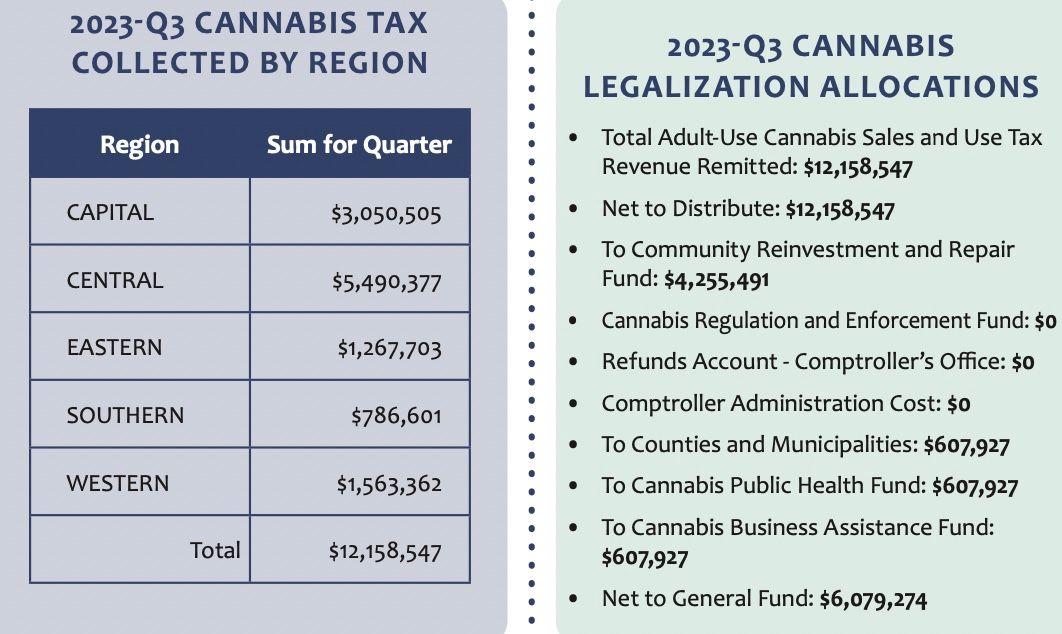

While there are no local cannabis taxes in Maryland, the state does levy a 9 percent excise tax on any product containing cannabis. But, a mere five percent of state cannabis tax revenue goes to local governments. That translates to local governments receiving a mere 45 cents for a single purchase of $100 of cannabis- the smallest in the nation.

Read more here.

Recent Articles

Website powered by Neon One | ©2023 All Rights Reserved | Maryland Wholesale Cannabis Trade Association